The energy sector hardly ever leaves the limelight, but just a few companies play a role as pivotal as the National Grid. Watching the National Grid share price become essential for making informed decisions when investing in either it or any other utility stock, be it by a seasoned investor or a beginner.

The utility stock functions as a representation of dependable business operations. The UK and northeastern United States region benefit from the energy services of National Grid which serves millions of customers in these areas. Clear operational and market responses by National Grid translate directly into its information presentation found on the portal.

In this guide, we will discuss what drives national grid share prices, how national grids fare against their peers, and the long-term potential as an investment.

What Is National Grid?

The National Grid is a major utility provider in the UK and selected states in the US. Its remit is the management of transmission of electricity and gas to homes, businesses, and important services, ensuring the smooth operation of energy supply without interruption. The company runs a highly regulated infrastructure with predictable returns. This attracts long-term investors. By contrast, share price fluctuations of the National Grid are relatively low, making it a more stable bet compared to other high-risk stocks.

National Grid shares are synonymous with reliability, stability, and continuous service. That is precisely what the national grid share price in the UK speaks for today.

Why People Watch the National Grid Share Price

Investors constantly track the national grid share price. It’s a measure of how the market feels about the company’s future. Share prices can reveal if confidence is high or if there are potential risks on the horizon.

A rising share price suggests strong performance or positive expectations. A dip might indicate concerns, either in the energy sector or specific to National Grid. It’s important to view the national grid share price in the context of broader market trends.

For long-term investors, the price also reflects potential returns, especially when combined with dividend payouts.

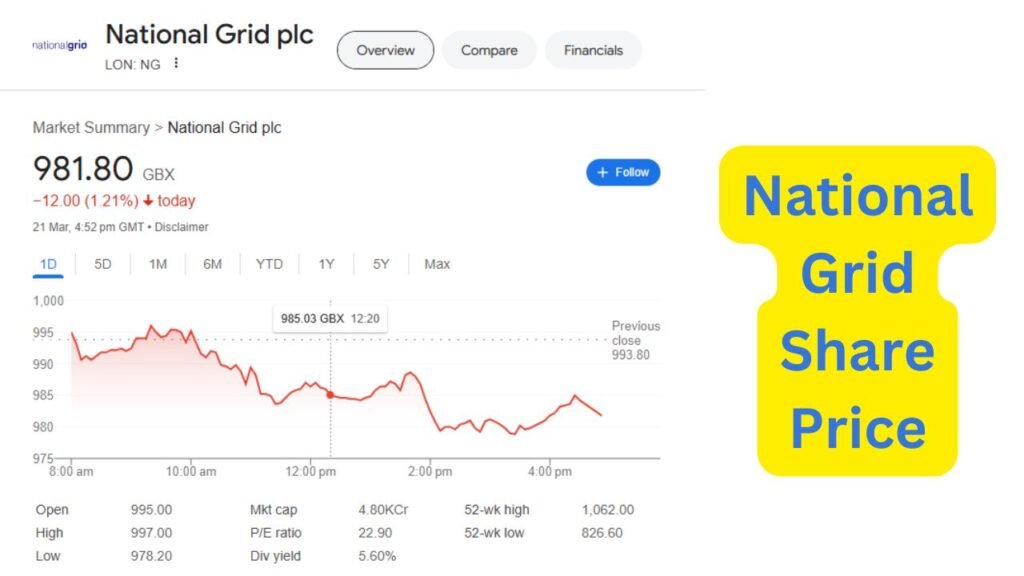

Recent Trends in the National Grid Share Price

Let’s look at how the platform has moved recently. It doesn’t show wild changes, which is typical of utility stocks.

| Month | Share Price (GBP) |

| Jan | 10.85 |

| Mar | 10.35 |

| Jun | 10.50 |

| Sep | 10.10 |

| Dec | 10.70 |

This stable trend proves why many investors consider National Grid a safe investment. It typically reflects slow and steady movement based on seasonal demand and economic factors.

What Affects the National Grid Share Price?

Several factors influence the national grid share price. These include government policies, interest rates, and energy prices. National Grid operates in a heavily regulated space. So, any regulatory update can impact its stock price.

1. Energy Market Trends

When electricity or gas prices change, it matters. High prices can mean more revenue. But costs may also rise. The balance between income and expense shifts value.

2. Policy and Regulation

Utility companies follow strict rules. These rules control how much they can earn. If governments tighten rules, profits may fall. If relaxed, earnings may improve.

3. Weather and Seasons

Cold winters mean more usage. Hot summers also raise demand. These patterns affect income. That often changes investor interest.

4. Economy and Growth

When the economy slows, energy use drops. Less demand can hurt performance. In strong economies, demand rises. That helps improve results.

5. Company News and Results

Good news boosts confidence. Poor earnings shake it. Investors look at profits, plans, and leadership. All these drive up or down movement.

Is the National Grid Share Price Safe?

Many investors choose National Grid because it offers long-term safety. The national grid share price UK performance remains relatively stable year after year. It’s not flashy, but it’s dependable.

Those who prefer steady income over rapid capital growth tend to like National Grid. It’s also less volatile compared to tech or financial stocks.

While it may not deliver massive returns overnight, its consistent dividends and market trust make it a secure choice. It supports low-risk investment goals.

Dividends and the National Grid Share Price UK

One of the most appealing features of National Grid is its dividends. Investors receive regular payments, which adds to the total returns even if the share price doesn’t move much.

| Year | Dividend Yield (%) |

| 2021 | 5.2% |

| 2022 | 5.1% |

| 2023 | 5.3% |

This consistency is a major reason why this platform draws long-term investors. Dividends are especially attractive when interest rates are low. And this adds to the appeal of this platform.

Comparing the National Grid Share Price to Other Utility Stocks

Let’s see how National Grid compares to other utility companies. It offers a solid yield and high share price stability.

| Company | Dividend Yield | Share Stability |

| National Grid | 5.3% | High |

| SSE | 4.8% | Medium |

| Centrica | 3.6% | Low |

It stands out as a reliable investment in the utility sector. It offers a better balance of returns and safety compared to many peers. It makes this platform more competitive.

Analyst Views on the National Grid Share Price

Market analysts generally rate National Grid as a ‘hold’ or ‘buy’. Its consistent dividends and stable earnings support its positive reputation. Some experts predict slow and steady growth due to infrastructure investments and green energy moves.

It reflects investor confidence, and many analysts believe its upward path will continue with time. In fact, some even expect the national grid share price UK to rise as demand for energy infrastructure grows.

How to Buy National Grid Shares and Track the Share Price

Buying shares in National Grid is straightforward. You can invest using any online trading platform. Here’s how to start:

Step 1: Pick a Trading Platform

Choose a platform that suits you. Look for low fees, safety, and user-friendly design. Many apps work well on mobile and desktop. Reviews and ratings can help guide your choice.

Step 2: Set Up Your Account

Sign up by entering your basic info. You’ll need an ID and bank details. Most accounts are approved in minutes. Once done, you’re ready to explore the platform.

Step 3: Search for the Company

Use the search bar to find the stock. Make sure the name and symbol match. Read the stock page to view current price, past trends, and recent updates. Double-check before buying.

Step 4: Decide How Much to Invest

Start with a small amount. Don’t risk too much early on. Some platforms let you buy fractions. Invest only what you’re ready to lose.

Step 5: Place Your Order

Select between a market or limit order. Market buys instantly. Limit waits for your chosen price. Review your order before you confirm it.

Step 6: Monitor and Track

Keep an eye on performance. Check your app daily or weekly. Look at price changes, news, and stock charts. Most platforms give tools to help you follow trends.

Once done, you become a shareholder and can benefit from dividends and gains in this platform.

Risks That Impact the National Grid Share Price

Even steady companies face challenges. These risks may not appear daily, but they shape long-term results. Being aware of them helps investors stay prepared.

1. Changes in Government Policy

Energy markets rely on rules. A shift in regulations can hurt earnings. New laws may limit income or raise costs. These changes often affect market confidence.

2. Rising Interest Rates

Utilities often borrow to expand. If rates go up, loans cost more. This reduces profit margins. It also limits future growth potential.

3. High Inflation Pressure

When prices rise everywhere, so do operating costs. This includes wages, fuel, and materials. If prices go up too fast, profit drops. This makes the stock less attractive.

4. Environmental Uncertainty

Storms and floods cause damage. Extreme weather interrupts service. Fixing these issues needs time and money. Natural disasters can reduce quarterly performance.

5. Public and Investor Reactions

News impacts people fast. A small issue may trigger big reactions. Panic selling can push the price down. Even strong companies feel this pressure.

Long-Term National Grid Share Price Performance

National Grid has grown steadily over the last decade. Its price has climbed gradually, reflecting strong fundamentals.

| Year | Avg. Share Price (GBP) |

| 2014 | 8.60 |

| 2016 | 9.40 |

| 2018 | 8.85 |

| 2020 | 9.95 |

| 2022 | 10.75 |

| 2024 | 10.50 |

The chart shows the slow but consistent nature of the national grid share price. This is why long-term investors appreciate its performance. Many believe that this platform will continue this trend.

Should You Invest in the National Grid Share Price?

If you’re looking for a safe and dependable investment, National Grid fits well. It’s share price offers gradual growth. And the regular dividend income adds more value.

This is not a stock for short-term gains. But if your goal is long-term income and stability, National Grid delivers. The national grid share price UK is backed by decades of market trust.

Tips for New Investors Watching this platform

New to investing? Start with reliable stocks. National Grid is ideal for beginners.

- Begin with small investments

- Reinvest your dividends

- Track the national grid share price monthly

- Read company news and updates

It gives insights into how a stable utility stock behaves. Learning from it helps build investment confidence.

Future Outlook for the National Grid Share Price

The energy world is changing fast. Modern systems and cleaner sources are becoming the focus. This shift opens new paths for utility providers.

1. Focus on Clean Energy

Many providers are moving to wind and solar. These are more sustainable. They also align with global goals. Cleaner energy can bring long-term rewards.

2. Expansion and Upgrades

Networks are growing. Older systems are being replaced. These upgrades improve service and cut waste. Better performance means more value for investors.

3. Strong Political Support

Governments back reliable providers. They want energy security. With backing, these companies stay stable. That support keeps the market calm.

4. Technology and Smart Grids

Digital tools are transforming power delivery. Smart meters track usage in real-time. These tools improve control and reduce loss. Innovation builds investor trust.

5. Steady Income Outlook

Many investors want predictable returns. Regular payouts give peace of mind. This makes utility stocks appealing. Stability will always attract interest.

Conclusion: Why the National Grid Share Price Matters

The national grid share price has consistently shown strength and reliability. This makes it a top pick for conservative investors. With stable dividends and a low-risk profile, National Grid stands out. It’s not just a utility company—it’s a long-term opportunity. Whether you are investing from the UK or abroad, the national grid share price UK trend signals strong potential. It’s worth considering if your goal is safety and income. Always review your investment goals. But if you’re looking for consistent returns, It makes a strong case for inclusion in your portfolio.

Read Our More Blogs:-